Lenovo Legion Go S is the first handheld console officially licensed for SteamOS

A new Lenovo Legion Go is set to arrive! At CES 2025, Lenovo announced a handful of new devices, and among them are the newest additions to its handheld console family. Well, one is technically still a prototype. Lenovo Legion Go S The Lenovo Legion Go S is still a Windows-based handheld gaming console and boasts a smaller 8-inch WUXGA display that supports 16:10 aspect ratio and a 120Hz refresh rate. While it is smaller than the 8.8-inch display on its predecessor, the Legion Go S supposedly has better optimizations for a better experience. Powered by either the AMD Ryzen Z2 Go or the AMD Ryzen Z1 Extreme processor, the Legion Go S offers up to 32GB of LPDDR5X RAM (7500 MHz). With a 55.5Wh battery, it’s built to keep you playing for hours, whether you’re on a plane, a train, or anywhere in between. Unlike its predecessor, the Legion Go S offers more connectivity options, including Wi-Fi 6e support and USB 4.0 ports, which make it easy to link up to other displays or peripherals. Lenovo has also integrated a microSD card reader, ensuring that you have plenty of room for all your game saves and downloadable content. It also retains the same heft as the original Legion Go, weighing in at 1.61 lbs (730g). But a key feature of the Legion Go S is its integration with SteamOS on the SteamOS-powered version, making it the world’s first officially licensed handheld running on SteamOS. This is a major shift from the original Legion Go, which ran on Windows, giving users the flexibility to choose between a Windows-based or SteamOS-based experience. This version of the device integrates fully with the Steam platform, giving gamers access to the entire Steam Store and Steam Library, as well as Remote Play to stream games directly from a PC. The cloud saves feature ensures that you can seamlessly pick up your game where you left off, whether you’re on your desktop or on the Legion Go S. The Lenovo Legion Go S is expected to hit shelves in 2025, though specific release dates may vary by region. As for the price, Lenovo has not officially confirmed any exact figures yet, but it’s safe to assume that this device will be positioned in the mid-to-premium price range. Legion Go Prototype While the Legion Go S is already official, Lenovo also had a prototype of the next iteration of its handheld gaming device on display at CES 2025, the Lenovo Legion Go (8.8”, 2) Prototype. This prototype is still in the development stage and is not yet available for purchase, but it hints at what the future of portable gaming might look like. The Legion Go Prototype features some impressive upgrades over the original, including an 8.8-inch OLED display with 144Hz refresh rate and Variable Refresh Rate (VRR) support, which makes for an ultra-smooth, crisp gaming experience. The display is noticeably larger than the original Legion Go, and with OLED technology, you can expect richer colors, deeper blacks, and better overall image quality. In terms of raw power, the Legion Go Prototype steps up with the AMD Ryzen Z2 Extreme processor paired with RDNA 3.5 graphics. These advancements should offer more graphical horsepower, especially for demanding AAA titles. The prototype also boasts up to 64GB of LPDDR5X RAM, which is double the amount available in the current Legion Go, offering improved multitasking and future-proofing for years to come. The prototype also has up to 2TB of SSD storage for gamers who need more space for their ever-growing game library. Lenovo is also incorporating a 74Wh battery, providing longer gaming sessions, and ergonomic improvements such as rounder controllers for better input accuracy. Lenovo has confirmed that some details may still be refined before the device is ready for the market. The company has not yet announced a formal release date or price, but they have teased that it could arrive in 2025

HONOR Magic V3 review: Seeing the future of foldables

HONOR Magic V3 feels like a culmination of what these folding devices are trying to achieve. It’s unexpectedly slim, and powerful, and it’s more affordable, too.

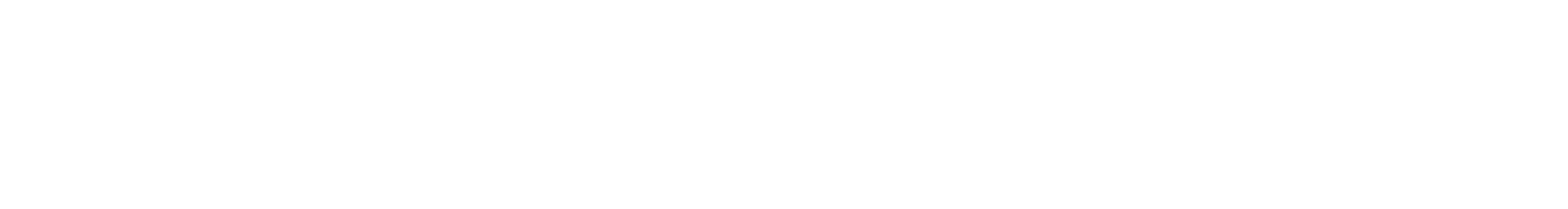

MSI reveals new 2025 laptop lineup featuring NVIDIA RTX 50 Series and AI

MSI introduced its laptop lineup featuring the latest NVIDIA GeForce RTX 50 Series graphics, powerful Intel Core Ultra processors.

Ultrahuman launches luxury smart rings made of 18K gold and platinum

The Ultrahuman Rare blends the advanced tech of a smart ring with the luxurious allure of fine jewelry

Huion Kamvas 16 Gen 3 drawing tablet offers a near-paper-like experience

The Kamvas 13 Gen 3 significantly reduces parallax and offset so there’s little to no gap between the pen tip and display.

Sony, Honda’s Afeela 1 EV now open for reservations after five-year wait

Deliveries for the AFEELA Signature trim are expected to commence in mid-2026, with the Origin trim following in 2027

Acer at CES 2025: Swift Go 14/16, Aspire Vero 16, and more unveiled

Acer has unveiled a fresh lineup of devices at CES 2025, including the Swift Go 14 and 16, as well as the Aspire Vero 16.

Shoebox-sized JMGO O2S Ultra is the world’s smallest laser TV

JMGO plans to officially launch the O2S Ultra in Q4 2025

ASUS ROG intros new 2025 Zephyrus laptops, a new XG Mobile, Flow Z13, and more

Here’s everything ASUS ROG announced at CES 2025

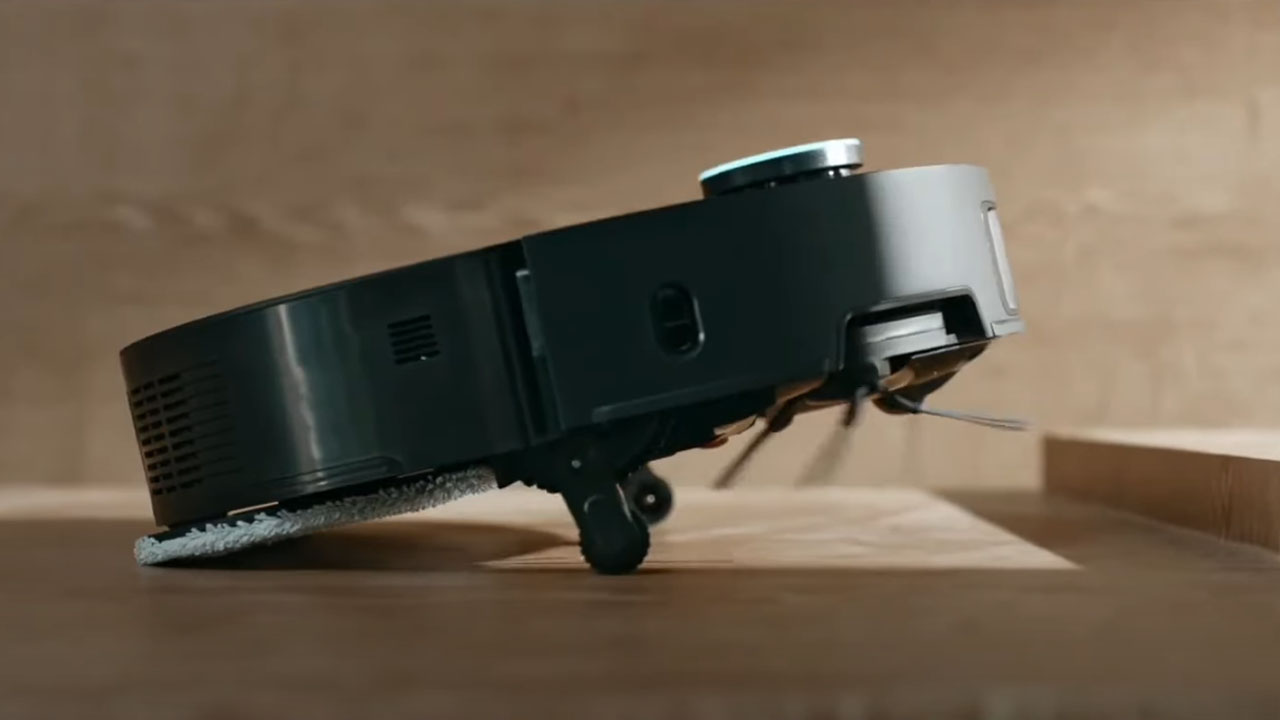

Dreame’s CES lineup includes the X50 Ultra stair-climbing robot vacuum

Dreame’s CES lineup includes the X50 Ultra stair-climbing robot vacuum, smart pool cleaner, and more

HONOR Philippines sets new Guinness World Record with 264-person drop test

On January 6, 2024, the company broke a Guinness World Record for “The Most People Performing a Mobile Phone Drop Test Simultaneously.”

instax mini Link 3: tips, tricks, and a quick review

Slightly more compact and with a refreshed look, the mini Link 3 boasts the same ease of use and portability.

Huawei MatePad 12 X now in the Philippines, priced

Huawei has launched its latest tablet, the MatePad 12 X, in the Philippines.

Snapdragon 8 Elite-powered IQOO 13 launches globally, specs and price announced

Launched earlier in China, the IQOO 13 finally starting to roll out globally. A powerhouse of a device, the IQOO follows in the footsteps of its predecessor offering flagship specs across the board, and is one of the first phones to be powered by the mighty Snapdragon 8 Elite. It also boasts a self-developed gaming chip, triple 50-megapixel cameras, and more. Here’s everything you need to know about the IQOO 13: Flagship performance from a fresh flagship chip One of the most notable things about the IQOO 13 is that it’s powered by the Snapdragon 8 Elite which was launched in October of this year. The Snapdragon 8 Elite is currently touted as the fastest mobile PC at the moment, fueling both AI and gaming. Compared to the Snapdragon 8 Gen 2, this chip speeds up things by about 30% and supposedly boosts performance up to 50% more. IQOO’s self-developed Q2 supercomputing chip, however, makes the setup unique. Working alongside the processor, the Q2 brings enhancements like 2K Game Super Resolution, which is designed to deliver “PC-grade” graphics while maintaining stable frame rates (up to 144FPS) even under high-stress scenarios. IQOO also updated its cooling system to manage heavier loads. The 7K Ultra VC Cooling System features the company’s largest vapor chamber to date and covers the main camera and battery components as well. It’s paired with a Cool Aircraft-grade aluminium frame for faster cooling and while the High Precision Temperature Algorithm provides smart cooling and industry-leading heat dissipation. Thin, sleek, durable, powerful It wasn’t too long ago that powerful smartphones were often bulky or niche in design. Of late, this is becoming less and less true, and the IQOO 13 is a prime example. The IQOO 13 comes in three subtle but sleek colors — Nardo Gray, Alpha, and the BMW M-inspired Legend. Both the Legend and Nardo colorways stand at just under 9mm thin and 213g in weight while the Alpha stands at under 8mm and is lighter at 207g. But one of the best things about the new design is its IP69 dust and water protection which means you can fully submerge the device up to 1m of water. The rating also means that the phone is fully guarded against dust and can withstand high-pressure and high-temperature sprays. Around its camera module is also the all-new Monster Halo lighting effect. Built with six visual effects and customization options, you can personalize the look and movement of the lights for music, calls, messages, charging, and of course, gaming. Apart from housing a powerful processor and its self-designed supercomputing chip, the slim profile of the IQOO 13 also packs a large 6150mAh battery, complemented by 120W FlashCharge. It also sports a 6.82-inch display made with Q10 Light-emitting material which increases brightness by 12.5% and color cast by 55%. Conversely, it reduces motion blur by 15% and power consumption by 10% as well. Interestingly, it also provides hardware-based eye protection by incorporating a circular polarized eye-protection (as opposed to the more common linear polarizing) layer that mimics natural light for more lifelike visuals. This apparently reduces the risk of astigmatism and dry eyes. It also debuts with vivo’s first Eye Care IP for all-around eye protection. These include 2592Hz PWM Dimming, Biometric Brightness Adjustment, Anti-Fatigue Brightness Adjustment 2.0, and Adaptive Ambient Color Temperature. Of course, it comes with some certifications as well including TÜV Rheinland Full Care Display, TÜV Rheinland Circular Polarization, and HDR10+. Triple 50-megapixel shooters and a strong selfie camera, too While not popularly known for its camera prowess, the IQOO 13 wants to make a different case this year packing a triple 50-megapixel camera setup that we’ve been seeing on flagships of late. At the core of this imaging system is a flagship-grade Sony IMX921 VCS Sensor main camera, complemented by a telephoto lens and an ultra-wide-angle camera. Each 50-megapixel shooter brings its own strengths, allowing users to capture everything from sweeping landscapes to intricate close-ups with remarkable clarity and detail. What truly elevates the IQOO 13’s camera experience is its advanced computational photography technology. Powered by the NICE 2.0 algorithm, the phone leverages artificial intelligence to dramatically enhance image quality, especially in challenging lighting conditions. Night mode becomes a particular highlight, enabling users to capture stunningly clear and vibrant photos even in low light. The camera system also offers creative features like multiple bokeh effects and a Street Photography mode that provides professional-level controls, essentially transforming the smartphone into a versatile digital camera that can adapt to virtually any photographic situation. IQOO 13 5G full specs Qualcomm Snapdragon 8 Ellite processor Adreno 830 graphics Supercomputing Chip Q2 12GB+256GB/12GB+512GB/16GB+512GB Funtouch OS 15 6.82-inch Q10 2K LTPO AMOLED Ultra Eyecare 144Hz refresh rate 4500nits peak brightness TÜV Rheinland Full Care Display certificationn TÜV Rheinland Circular Polarization certification HDR10+/Netflix HDR/Amazon Prime Video HDR 6150mAh battery capacity (except India) 12oW FlashCharge IP68/IP69 50-megapixel Sony IMX921 VCS True Color Camera 50-megapixel S5KJN1SQ03 Ultra Wide-Angle Camera 50-megapixel Sony IMX816 Telephoto Camera 32-megapixel front camera Wi-Fi 7 Bluetooth 5.4 Dual-frequency GPS

nubia V70 Design now in PH, priced

nubia has introduced its latest smartphone, the V70 Design, in the Philippines for under PhP 6K