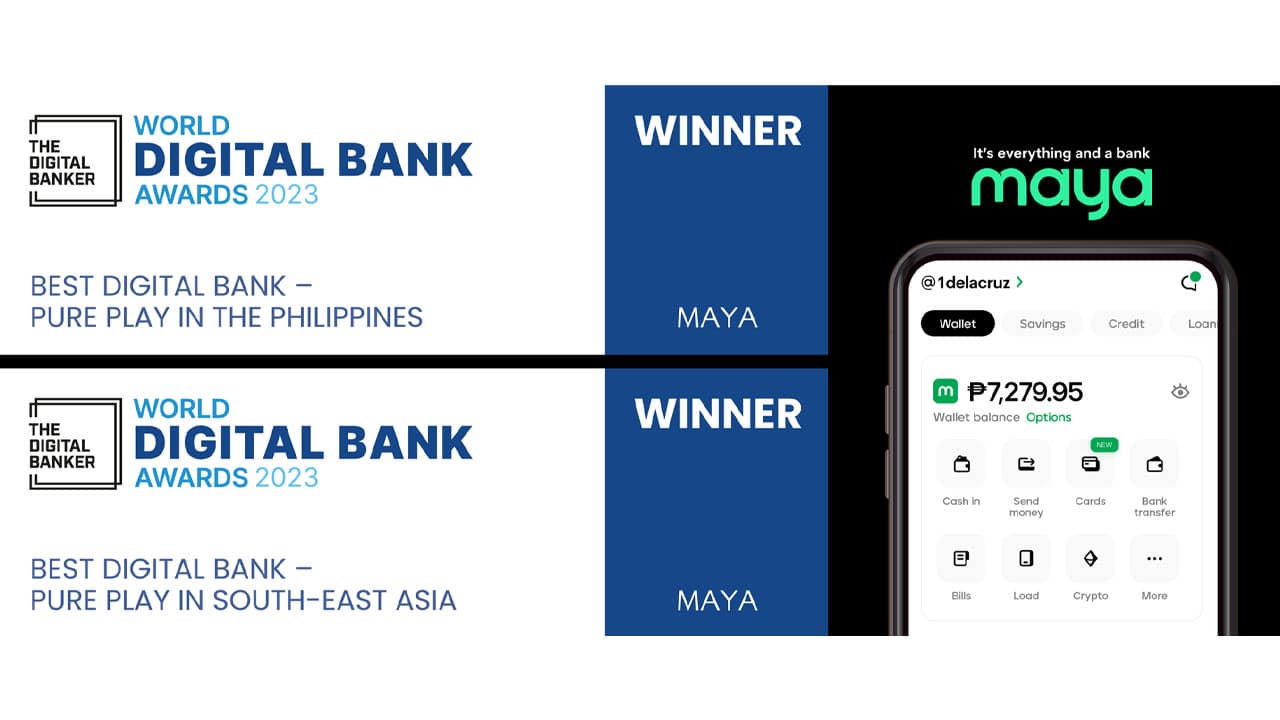

Organized by The Digital Banker, the WDB Awards, highlighted Maya’s cutting-edge product innovations, exceptional customer experience, and unparalleled market leadership. With these qualities, Maya was able to earn the 8th spot in the Top 10 global digital banks, alongside esteemed names like Starling Bank, Kakaobank, Revolut, WeBank, NuBank, and MOX Bank.

The Digital Banker’s commendation reads: “Philippine-based Maya has combined the power of its e-wallet proposition to offer savings, instant credit, and cryptocurrency services under a seamless experience. It’s one of the best examples of how digital banks are reimagining the digital process to drive customer interaction and usage.”

Angelo Madrid, Maya Bank President, expressed his gratitude, acknowledging the record-breaking achievements and their dedication to expanding digital banking services across their consumer and enterprise ecosystem. As of June 2023, Maya has attracted 2.3 million depositors with nearly PhpP25 billion in deposit balance.

Cumulative loan disbursements reached Php10 billion, and the app has earned recognition as the #1 highest-rated local consumer finance app on Google Play and Apple Store.

Maya Group President and Maya Bank Co-Founder, Shailesh Baidwan, emphasized the honor as a testament to the hard work and talent of their world-class team, showcasing the Philippines as an incubator for top fintech and digital banking enterprises. Notably, this recent accolade adds to Maya’s list of achievements, including Forbes Magazine’s World’s Best Banks, CB Insight’s Fintech 250, and the Digital Bank of the Year at the Future Digital Awards for Fintech & Payments in 2022.

Being the sole provider in the Philippines to offer comprehensive financial services through a single, fully digital platform for both consumers and enterprises, Maya has emerged as a pioneering force in Southeast Asia.

The app provides users with an all-in-one digital banking experience, offering reliable e-wallet services for daily transactions, virtual and physical cards, easy-to-use cryptocurrency options, high-yield savings with daily interest rates and personal goals, instant credit, and 24/7 chat support—all within a secure and seamless environment.

Moreover, Maya Business Manager has revolutionized the enterprise experience, providing an all-in-one bundle of omnichannel payment solutions, streamlined payroll, and supplier disbursements, and banking services such as business deposits with a 2.5% interest rate and MSME credit lines—all accessible through a single digital platform.