06/12/2020

Even as most of the quarantine rules have been relaxed across the country, digital financial services leader PayMaya said it is safer and more efficient for Filipinos to pay their government dues online and using cashless methods, options which are already available for the convenience and safety of citizens.

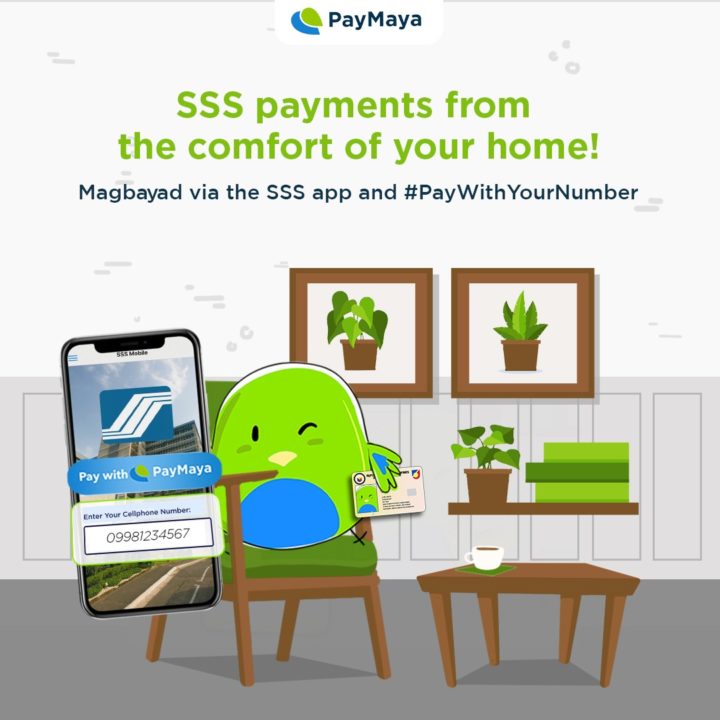

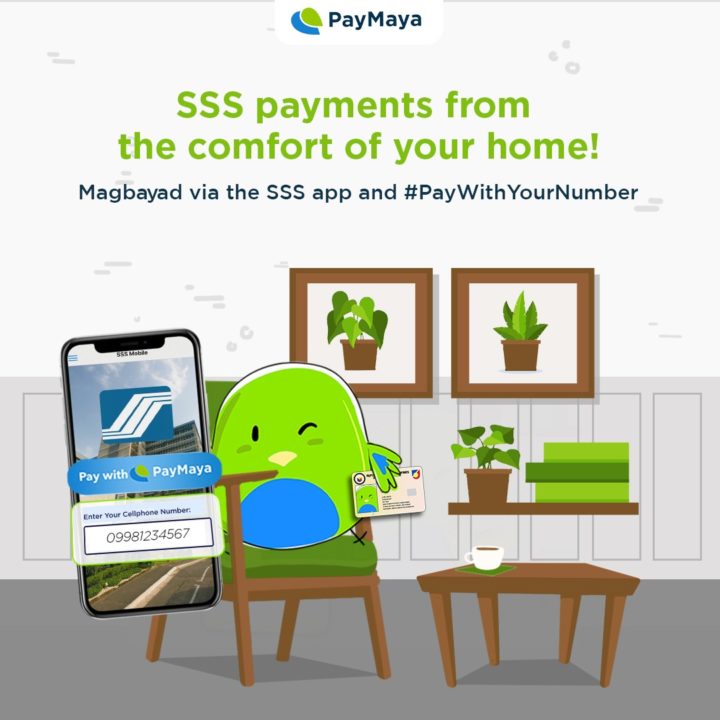

Government agencies such as the Bureau of Internal Revenue (BIR) and the Social Security System (SSS) have announced a final extension for tax filing and membership dues, respectively, until June 15, 2020.

Citizens can easily pay for their BIR and SSS dues using their PayMaya accounts from the safety and comfort of their homes. For BIR, convenience fees are waived when they pay using the Pay Bills section of the app, while they can get a chance to earn up to 100% cashback when they pay their fees using their PayMaya accounts via the SSS mobile app.

Empowering the government to go digital

Aside from BIR and SSS, PayMaya has also enabled more government agencies and units with the ability to accept card and e-wallet payments as the whole country accelerates its digital efforts in light of the effects of the COVID-19 pandemic.

These agencies and units include the PAG-IBIG Fund, Department of Trade and Industry (DTI), the Professional Regulation Commission (PRC), the Department of Science and Technology (DOST), the Department of Foreign Affairs (DFA), the National Home Mortgage Finance Corporation (NHMFC), and the City of Valenzuela, among others.

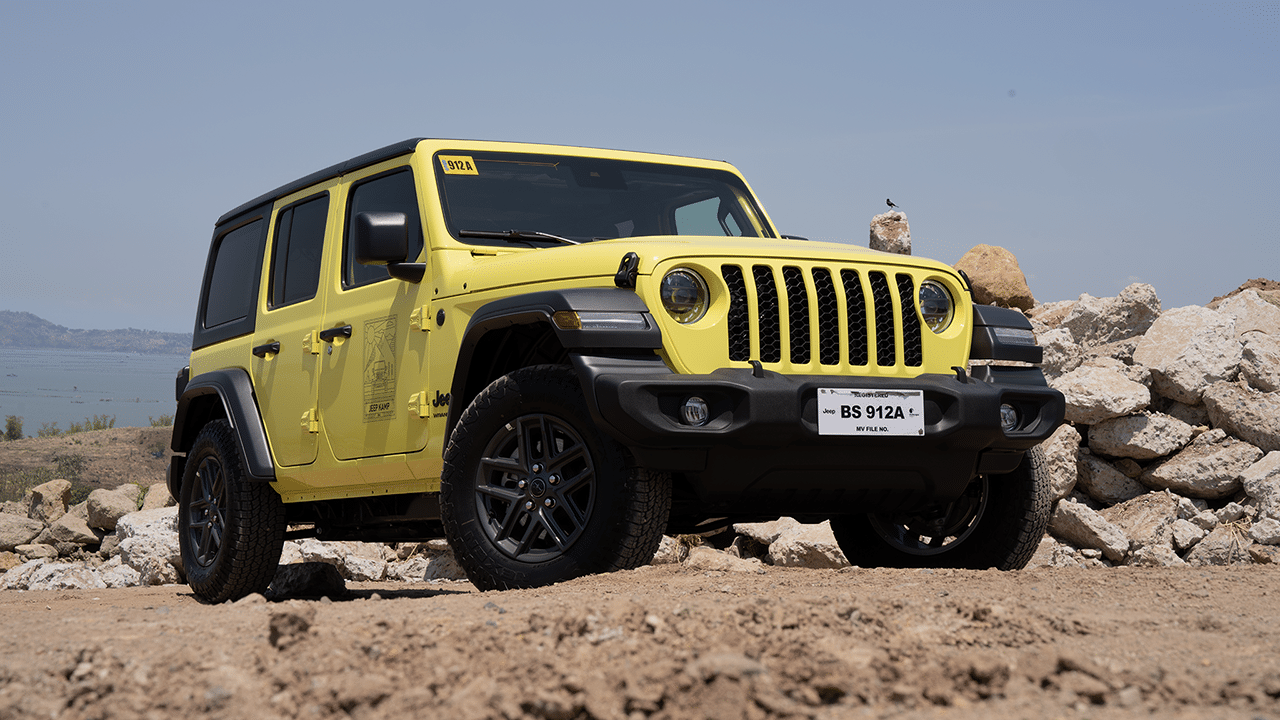

PayMaya has also partnered with the Department of Transportation (DOTr) and the Land Transport Regulatory and Franchising Board (LTFRB) to equip public utility vehicles (PUVs) such as taxis, buses, and TNVS cars with cashless payments acceptance for commuters.

“We support the government’s efforts to fast-track digitalization efforts for better delivery of public service. This is in line with increasing efficiencies in government services as the country moves towards the New Normal post-pandemic. We at PayMaya are excited to work with more national government agencies and local government units towards those same goals” said Orlando B. Vea, Founder and CEO of PayMaya.

As Filipinos’ day-to-day lives and the economy have been reshaped by the pandemic, Vea said digital payments will become commonplace across all areas of life, making it imperative for more government agencies and local government units to offer cashless means as the primary option.

In addition to convenience and safety, shifting government transactions online also helps facilitate the delivery of more efficient and transparent service to the public, as the Anti-Red Tape Authority (ARTA) had recently pointed out.

How to set up your PayMaya account

To register for a PayMaya account for quick and safe government payments, visit their page or download the PayMaya app for free today. Aside from government transactions, users can also pay other bills, buy airtime load, send money to their loved ones, or shop for groceries and other essentials online using their PayMaya account.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cuts across consumers, merchants, and government. Aside from providing the payment acceptance for the largest e-Commerce, food, retail and gas merchants in the Philippines, PayMaya is enabling national and social services agencies as well as local government units with digital payments and disbursement services.

Through its PayMaya app and wallet, it is providing millions of Filipinos with the fastest way to own a financial account with over 40,000 Add Money touchpoints nationwide, more than double the total number of traditional bank branches in the Philippines combined. Its Smart Padala by PayMaya network of over 30,000 partner agents nationwide serves as last-mile digital financial hubs in communities, providing the unbanked and underserved with access to services.

To know more about PayMaya’s products and services, visit their official website or follow @PayMayaOfficial on Facebook, Twitter, and Instagram.

Press material from PayMaya