06/02/2020

One of the products of being in quarantine is the rise of cashless payments not just for convenience, but also for safety. This is because contactless payments lessen the chance of bacteria or virus transferring through the exchange of paper money and coins.

Going beyond that, this service also offers a host of other benefits like rewards points, discounts, and promotions. And once travel becomes safe again, going cashless is probably one of the most convenient ways to pay when you’re abroad.

A couple of years back, there weren’t many options for cashless payments apart from credit cards and debit cards. And while those are still very viable and reliable services today, technology has provided new, easier, and more accessible ways to transition into the use of these virtual wallets with some of them having contactless options.

If you want to adopt this payment method but don’t know where to start, then keep reading on as we list some of the popular apps and services (not credit cards) that can help you get started.

PayMaya

Paymaya is probably one of the most popular apps to use today for contactless payments because of the number of services it offers. It gives you a virtual prepaid credit card that you can use as a regular credit card online. Being prepaid, you get the option to load in the exact amount you need or even plan ahead and load your budget for the day/week/month so you can also track your expenses.

Services: Virtual prepaid card, QR code payments, bills payments, prepaid mobile reloading, send money to other users or banks, cash-out to banks or remittance centers, optional physical card

Cash-in methods: Online bank transfer, physical self-service kiosks, debit or credit card, partner establishments, and merchants

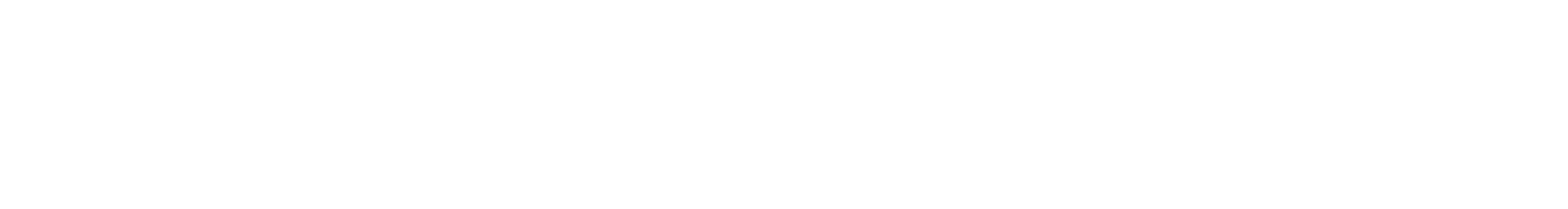

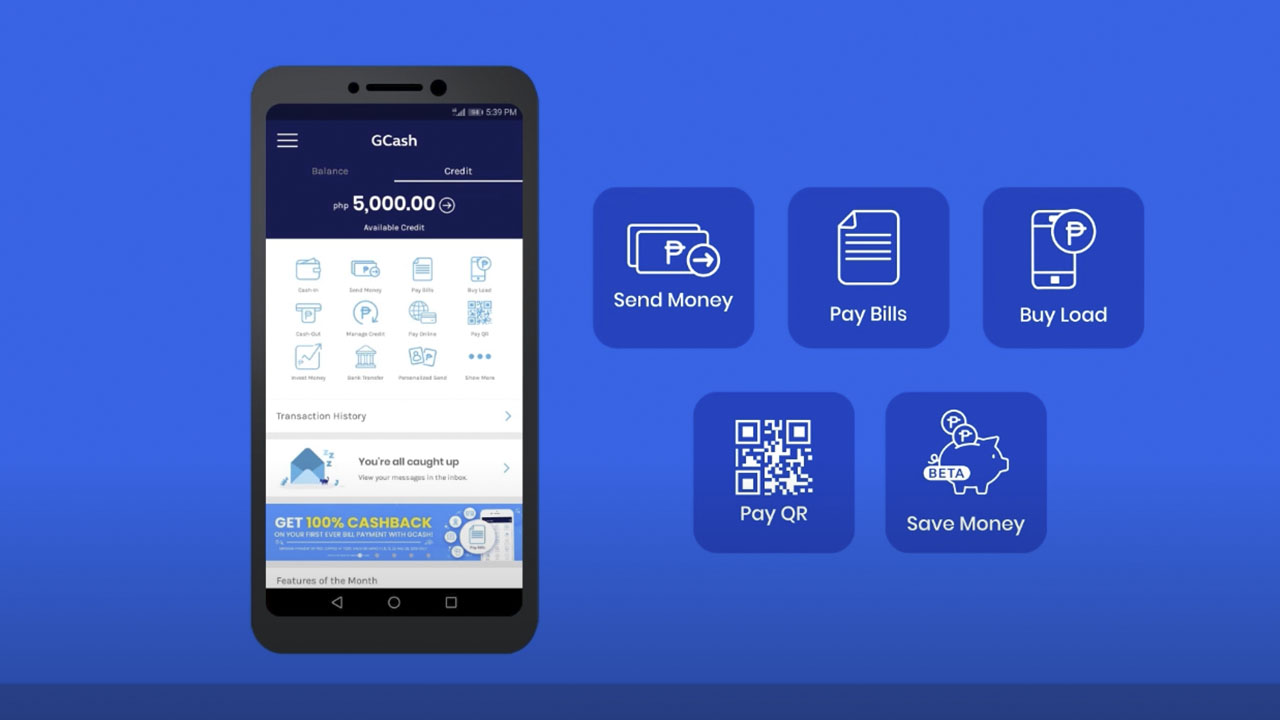

GCash

GCash is right up there with PayMaya in being a widely used payment service. A product of Globe Telecom, GCash also operates as an app but acts as a mobile wallet instead of a prepaid card like PayMaya. You can, however, also avail of the optional GCash Mastercard to get a physical card and number that you can use for online or physical purchases. Unfortunately, GCash is limited to Globe Telecom customers only.

Services: Bills payment, send money to other GCash user and banks, cash-out at partner outlets or ATM, buy and borrow mobile load, buy in-store with partner merchants, GCredit.

Cash-in methods: Through Globe stores, partner outlets, online bank transfer

GrabPay

GrabPay is a mobile wallet service that comes from the ride-sharing company, Grab. Initially created for easier payments for its services, GrabPay has evolved beyond that and can now be used for other non-Grab related services. Customers can access GrabPay through the original Grab app.

Services: Payment for Grab services, bills payment, prepaid mobile reloading, transfer to other GrabPay wallets, cash out to banks, in-store payments with partner merchants, online payment with partner merchants, and apps

Cash-in methods: Grab drivers, Online bank transfer, ATM transfer, over-the-counter bank transfers, debit or credit card

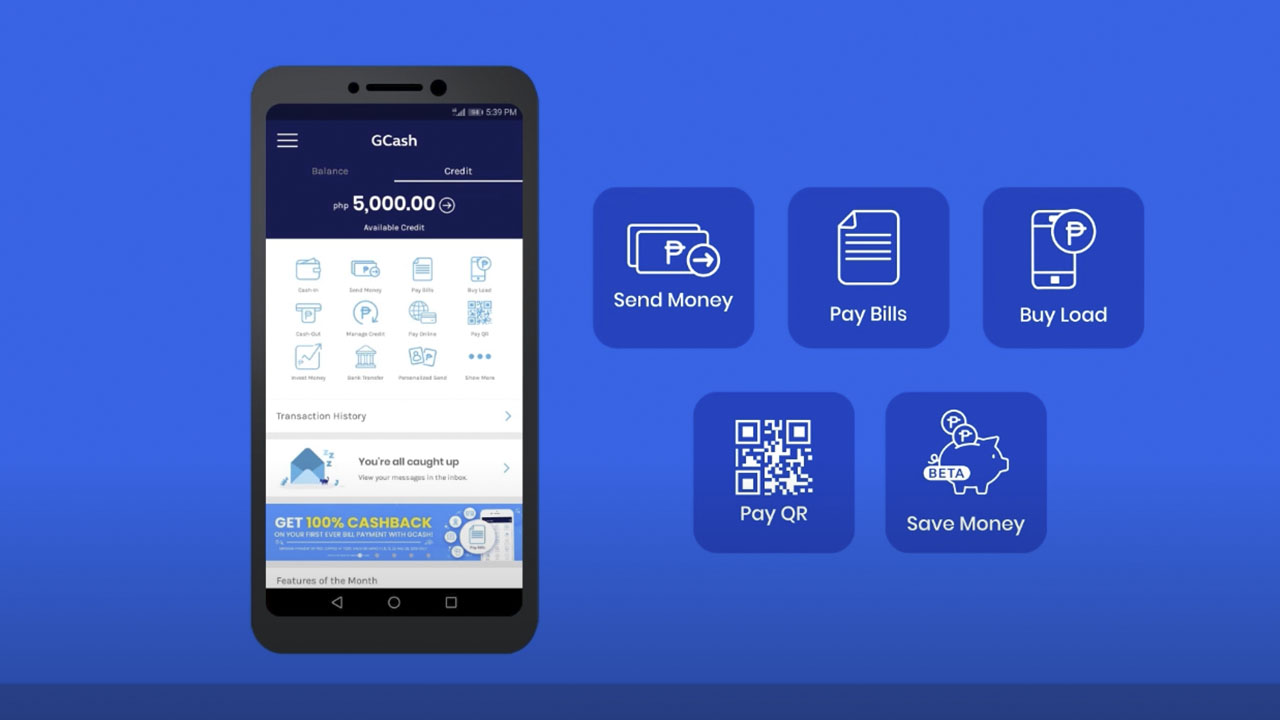

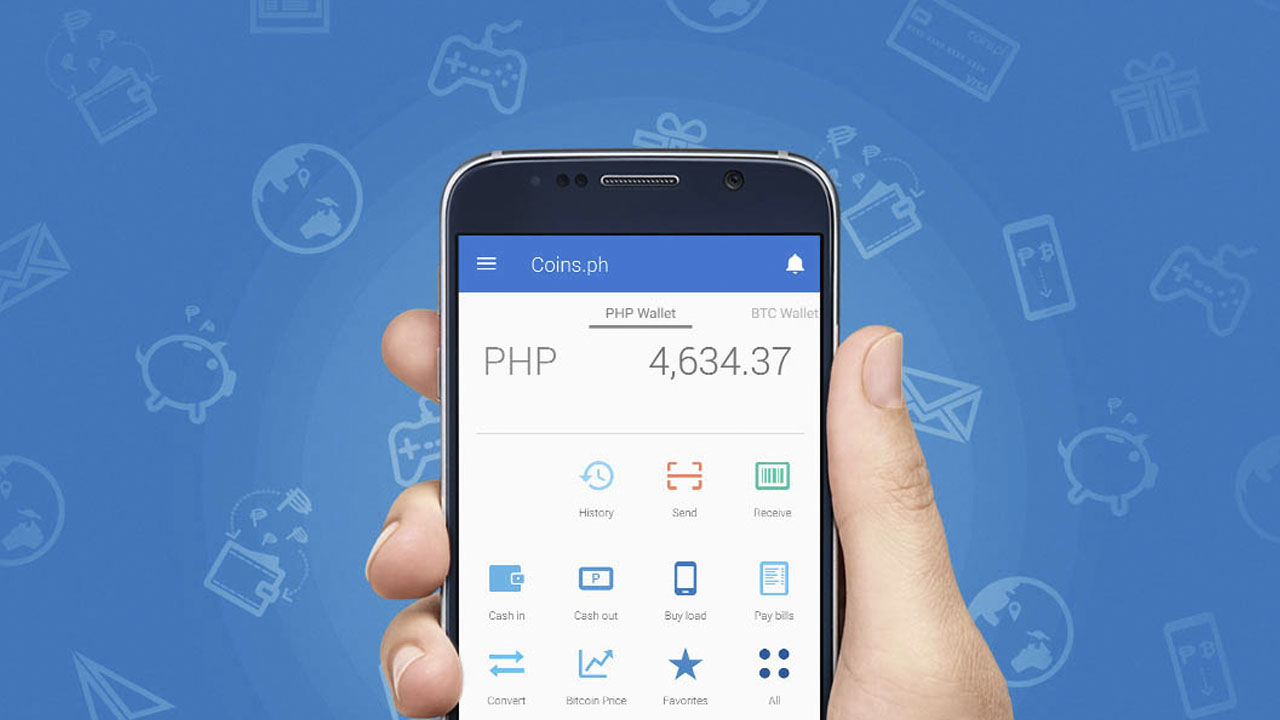

Coins.ph

While not as widely popular as others, Coins.ph offers a capable mobile e-wallet solution like GCash. It’s an app-based service like the others but what makes Coins.ph different is that it’s the first licensed virtual currency provider in the Philippines. Interested customers can purchase digital currency like Bitcoin, Bitcoin Cash, or Ethereum through their platform.

Services: Bills payment, prepaid mobile reloading, send money to other users or bank account, payment request, purchase game credits

Cash-in methods: Partner merchants, physical kiosks, GCash, online bank transfer, over-the-counter banking,

PayPal

PayPal is a payment service that’s been around for a very long time now. It’s probably one of the most globally-recognized online payment solutions around. It recognizes different currencies and is accepted in most local and international stores. With a multitude of features, PayPal mostly focuses on personal and commercial payments and doesn’t offer local services like direct bills payment. It’s important to note, though, that PayPal will need its users to be registered in order to send and receive money. Accounts can then be linked to banks or cards for cashing in and out.

Services: Send and receive personal payments, commercial payments, cash-out to banks or cards, payment to local and international partner merchants, GCash and PayPal integration

Cash-in methods: Bank transfer, credit and debit card transfer

Special mention: beep

Metro Manila’s Beep card is fairly new but a great initiative in introducing a cashless payment system for local transportation. Like Hong Kong’s Octopus card or Japan’s ICOCA, BEEP is an RFID-enabled, stored value card that can be used for trains and buses in the city. And with the current pandemic, contactless payments during commutes should be the choice to lessen the possibility of being infected.

Services: Payment for LRT1, LRT2, and MRT trains, payment for Point-to-Point buses, BGC Bus, Citylink Coach Services, toll payments on NLEX and CAVITEX, in-store payment at partner merchants

Cash-in methods: LRT and MRT stations, beep e-load stations, Bayad Centers, partner merchants, Coins.ph app, selected bus ticket booths, Family Mart, Circle K

Final Thoughts

With technology rapidly evolving, it won’t be surprising if a few more options for cashless or contactless payments pop up. Apart from those listed above, there are already other options like BPI’s QR code payments, WeChat Pay, AliPay, and others. Bottom line is, cashless payments are becoming the norm and are, truthfully, a whole lot more convenient than having to line up in banks, hand cash for deliveries, or visit individual payment centers to settle bills. We may be far from being a completely cashless society but the fact that we have more than one option to do so is already a great start.

CHECK OUT: Fashion Revolution Week 2020 pushes for sustainable ways to make clothes